Introduction to Selling a House in Probate in North Carolina

I don’t know about you, but for me, selling a house in probate is the very last thing I want to do when I am already dealing with grief and loss.

Can you blame me though?

The probate process in North Carolina is not a walk in the park.

And if you have a probate property that needs to be sold, it could take you months of back and forth, paperwork and legal fees to get it done.

This makes a probate challenging and taxing on family members who may be processing a loss.

What’s so challenging about a probate sale in North Carolina?

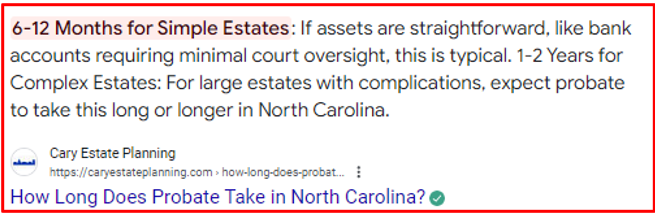

Well, for one, it just takes a stupid amount of time to get done:

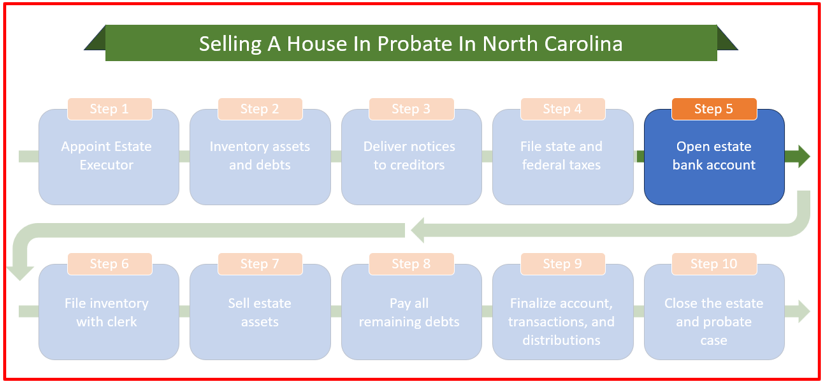

And two, there are at least ten different steps involved in settling an estate in North Carolina.

If they were truly just steps, then that would be one thing, but a better way to describe them might be milestones.

In this article we will outline what probate is and why North Carolina requires it on all estates.

You’ll learn:

- How to sell a house in probate in North Carolina

- The different types of probate that North Carolina processes

- Why selling the house to a cash buyer might expedite your probate

- How to make sure you “check the box” on all legal and financial probate obligations

Let’s dive right in!

- There is no way around probate in North Carolina. It’s a requirement if for the deceased’s estate. Selling property within a probate is very common.

- Probate property can be challenging to sell on the open market for a number of different reasons. On top of that, it’s imperative that probate property sells quickly to not stall legal and probate fees.

- Selling a house during probate to a cash buyer is cheap, easy and fast. Cash buyers can give you a free, no obligation offer to purchase your probate property in North Carolina.

Understanding the Probate Process in North Carolina

So, you’re looking to sell a house in probate in North Carolina, but where do you even begin?

The first step is driving down to the clerk or court and kicking of the estate administration process.

You will need the following to successfully do that.

Legal Minimum Requirements:

- Any and all wills left by the deceased. If there are none, you will need to note that on the form.

- A certified death certificate of the deceased’s probate you are starting.

- On the application it will ask about a inventory list of the estate. In there, the house would be just one of the items to include related to the deceased’s property.

- A $120 filing fee.

So far, pretty simple.

Here’s where it can get complicated.

The probate process in North Carolina divides into two main types of probate:

- Formal Probate – A court proceeding is required to process a formal probate. There are hearings, judges and many other obstacles to tackle with a formal probate making it much more expensive and time consuming.

- Informal Probate – No formal court proceedings are required for informal probates. The estate can be settled outside of court as long as certain conditions are met.

The complications begin to arise when the North Carolina probate court decides which probate process is needed: formal or informal.

For one, there’s very little transparency in what drives that decision. Many lawyers and attorneys speculate that the size of the estate ($20,000 or $30,000 maximums) drives the decision, while others cite whether or not there are wills or disputes.

It’s just not clear and transparent to the decedents of the deceased and ultimately creates frustration as time and money is spent figuring it all out.

For you, if real estate is going to be part of the probate, then it is very likely that a formal probate process is going to ensue. This isn’t the end of the line though. You can still expedite and simplify probate by selling the home quickly to benefit the estate’s financials.

If you inherited a house in probate and need to sell it, my team and I can give you a cash offer that simplifies and closes out your probate headaches immediately.

When Is Probate Required In North Carolina?

Always. Some level of probate is always required in North Carolina.

As you may know by now, probate is essentially the carrying out of the last will and wishes of the deceased.

This includes instructions for distributing anything…literally, anything. And to anyone, family, friends or others.

Word to wise, be prepared for probate to challenge your relationships and create disputes.

Don’t believe me? Check out this example:

Source: Reddit

It’s most common that money, jewelry, homes, vehicles, and so on are key components of a probate.

However, probate can span many other assets and materials. You can even inherit a dog or cat!

But what if there is no will?

What if the person died suddenly without any directions for their estate.

This is referred to as dying intestate.

Regardless of whether or not a will is in place, all estates must go through the probate process in North Carolina.

And in the case of no instructions (i.e., no will) the probate process is designed to split the assets among the deceased’s family members…even if this is not truly what they wished for.

Key Legal Steps in the Probate Process

As we alluded to in the beginning of this article, there are ten steps in getting a probate across the finish line in North Carolina.

In my experience of helping sellers navigate probate in North Carolina, the biggest and most important step is going to the be the first one:

Appointing an executor or administrator of the estate.

Having the right person lead the effort and execute the probate is crucial.

They handle the paperwork, coordination, disputes, fees, etc.

Appointing Probate Executors In North Carolina

I cannot underscore how important this is.

And top of that, being an executor is not easy if you have other priorities in your life (jobs, families, children, etc.)

Let’s talk real numbers:

On average, the executor of an estate spends 50-60 hours settling the affairs and last will of the deceased.

Additionally, there are over 300 documents that the executor must process in North Carolina to successfully execute a probate.

Executors run the “probate” show on behalf of other heirs. There may be other interest parties, but executors call the shots on timing and decisions for the deceased person’s estate.

If you’ve been appointed an executor, take a minute to plan this all out. The more you think ahead, the better it can go.

The 10-Step Framework To Sell A House In Probate In North Carolina

After the executor of the probate process has been identified and appointed, it’s time to officially start the process.

Over the years, I always point families to this ten-step framework to help them anchor on expectations and timing of a probate.

Here’s why it’s important:

Having expectations helps family members understand just how much work a probate can be.

It also reduces the amount of phone calls, text messages and questions about the estate.

A framework can unlock much more benefit between you and your loved ones during this time. It’s a common language that you are all speaking related to the probate and it helps ensure that you can trust all parties involved.

Here is the 10-step probate framework you can expect in North Carolina:

Preparing the Probate Property for Sale

Any and all real estate properties inside of your probate could be some of the largest and most valuable assets that are to be divided.

This is the number one reason heirs sell the real estate in a probate:

To divide the dollars evenly amongst members.

If you’re probate is moving along and you’ve decided as a family to sell the house or home of the deceased, then it must mean you are closing in on Step 7:

The good news is that selling the house in probate can expedite the rest of the time and expenses related to probate.

The bad news is that it can also balloon both of those things as well if you’re not careful.

You might be wondering, what could possibly go wrong with selling the house during probate?

For one, it could stall your probate process for an additional 6-12 months.

Picture that, you moved all the way to step 7 to only sit there for a year until the house sells.

Then, when it finally does sell, the proceeds are much less.

Why?

You had to settle for a lowball offer after sitting on the market for 12 months. Your “rockstar” agent also charges 6% which is another large chunk of change gone.

This kind of thing is difficult to avoid.

You know it. I know it.

Here’s why:

Probate homes are often neglected because they aren’t well maintained in the owner’s last few years or possibly even behind of loans and liens. Taking these properties to the open market doesn’t always work well.

Here’s the reality. Selling probate homes often means:

- Expensive realtors (6% of the total sale). Specialized probate real estate agents charge a premium to deal with multiple heirs and navigate complex probate sales.

- Property appraisals may not support the value.

- Lists of repairs and deferred maintenance issues that plague the property listing.

- Home inspections that unearth major issues (think foundations, water damage, mold, etc.)

- And any house up for sale worth its asking price should be staged to reflect the highest and best showing. This is another expensive add-on.

All in all, it could be thousands of dollars before you get the house sold and months of showings and negotiations.

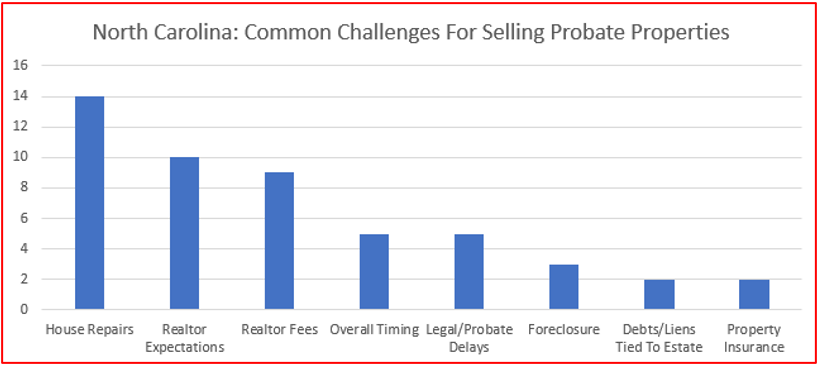

Let me share some data to further articulate the types of ongoing expenses I’ve seen with probate properties (listed in no particular order):

- Loan Expenses – interest accruing on outstanding mortgages tied to deceased’s property

- HOA Expenses – ongoing HOA dues for deceased’s property (typically paid monthly or quarterly)

- Property Taxes – annual taxes for city, sewer, school and public utility

- Utilities – expenses for gas, electric, water, propane, etc.

- Insurance Premiums – annual amounts due for homeowners insurance to cover liability

- Liens – either mechanics or utility liens placed against the property as collateral

- Judgments – court ordered judgments tied to the property as collateral

This list is just some of the existing expenses you can pay just to keep the probate property afloat. The selling expenses, as listed above, are incremental fees you will pay when selling the house traditionally with an agent.

Probate Services You May Need In North Carolina

At this point, you might be thinking about easier and cheaper ways to sell your house in probate. After all, every dollar you can save or make from probate is another dollar that you will inherit.

It’s crucial to having the right people on your side when you start the probate process.

Luckily, my team and I have put in the hard work and built a fantastic list of resources that you can use in North Carolina:

| Resource | Reason | Contact |

| Probate Attorney | A good probate attorney can quarterback much of the tasks and details behind your probate | Cary Estate Planning (919) 443-0435 |

| Estate Accountant | Ensures all taxes are paid on inherited property in North Carolina | Steward Ingram & Cooper (919) 872-0866 |

| Junk Removal | It’s quite possible that the house in probate is still full of belongings. Junk removers can make quick work of that. | Junk Trunk (252) 412-5957 |

| Cleaners | Cleaners are great if you plan to show the property or prepare it for a traditional sale. | Cary Clean Team (984) 409-9639 |

| Locksmiths | Many times, there are missing keys or not enough for access. A good locksmith will ensure the property is secure and accessible. | Carolina Locksmith (919) 608-3694 |

| Landscapers | There are some instances where you just need the grass cut or leaves collected. Hiring a good lawn care service goes a long way. | Haven Landscape Design (704) 318-5199 |

| Home Buyers | If you decide that listing the house is too expensive or takes too long, you can sell directly to a home buyer in North Carolina. | Cash House Closers (984) 265-8500 |

Methods of Selling a Probate Property

I’ve given you the “how it works”.

I’ve given you my list of resources.

Now it’s crunch time. Time to sell your house in probate.

There are two main probate sale methods for getting this done.

You can hire a real estate agent or your can sell directly to a cash home buyer.

Let’s compare!

Market and List the Property with an Agent

As you know by now, the traditional and common approach is to hire a real estate agent to sell a house during probate.

Agents are great resources and they can create a probate property listing that will get the job done. Typically, 3-9 months is the expected timeline from finding your agent to closing on the sale.

In North Carolina, agents deploy all of the common marketing strategies from listing on the MLS, to marketing on social media and connecting buyers through other brokerages.

Having your probate listing out there and accessible to the general real estate market is a huge benefit to getting the most market value from your home.

However, it is costly and it does require time to be effective.

Agents not only cost you 5%-6% on the sale of your probate listing, but they also have a more time-consuming and expensive process specific to selling probate property in North Carolina.

So, all in all, you’ll pay for their commission, the junk removal, the cleaning, the landscaping, the locksmith, the repairman and so on. Not to mention the continued legal and probate fees for keeping your attorney engaged and on retainer.

On top of all of that, it also takes quite a while to get it done from start to finish.

If all of that sounds pricey, it is.

But there’s an alternative option.

Sell Directly to a Cash Buyer In NC

By selling your probate house directly to a cash buyer, you avoid all of the fees mentioned above.

Cash house buyers can buy your house regardless of where you are in probate which can reduce the expense and time involved from all parties.

Also, cash offers are easy and reliable.

Converting your probate home into cash is a great way to split the proceeds between heirs and close out the probate proceedings sooner rather than later.

Special Cases: Selling As-Is and Handling Repairs

Think about it:

Getting a cash offer from a home buying company can get you results in a fraction of the time the traditional way does.

And to add to that, these home buying companies buy properties “as is”. You don’t have to empty out the deceased’s belongings or even clean and repair the property.

Distressed property buyers, such as Cash House Closers can be a perfect fit for buying your probate house if it requires extensive repairs or only qualifies for a cash sale anyways.

Do you have a North Carolina home stuck in probate that you wish to sell?

Get My Cash Offer Now

Navigating Probate Court and Legal Approvals

Okay, so you made a choice and have a buyer for your house.

Congrats. Almost done!

Let’s talk about some of the minor details around making sure you finish this probate legally and with everyone’s consent. After all, probate is a legal matter.

First off, you’ll need to figure out if your probate is formal or informal.

As we covered earlier in this guide, informal is preferred but it’s not always how things go.

If you’re probate is formal, you will need to obtain court approval for the sale. You can do this by having your attorney present the buyer’s offer to the judge. It’s typically approved, but make sure that you have the following for the court hearing:

- The signed purchase and sale agreement

- Proof of funds or funding from the buyer

- Beneficiary consent of proposed offer in writing

- Any real estate appraisals issued

- The closing attorney’s contact information

Once you get an outcome, it’s important to inform all of the heirs and beneficiaries. This is their inheritance too, so make sure they are onboard with the offer and plan to proceed. Beneficiary consent is best obtained in writing.

Quick tip light bulb: If you’ve been issued Letters of Testamentary it means that you are in charge of administering and dispersing of the estate’s assets. It’s a legal document that would have been issued directly to you, as the executor, by the clerk of court in the beginning of the probate process.

Challenges and Considerations for Selling a Probate Property In North Carolina

To no one’s surprise, selling a house in probate is not a walk in the park.

Selling a house in general could be full of obstacles and challenges, but selling a house through an estate in North Carolina is not any easier.

Here’s a quick preface to what I’m about to share with you related to the challenges you can will face when selling a house in probate in North Carolina.

My team loves data.

We collect a ton of it when homeowners call us and ask us to purchase their homes.

Every little hiccup, probate sale challenge or bump is documented in our CRM system.

When I filter for “probate” in our database I am basically filtering for homes we purchased through probate in North Carolina.

These are the most common problems we tracked in our system and helped sellers solve for:

Final Steps: Closing the Probate Sale

Getting the probate sale across the finish line is tricky, but totally doable with enough time and money.

The closing process itself is very typical of any other property closing. However, it’s important the funds from closing, after accounting for all debts and liens tied to the property, are sent for distribution to the estate’s bank account.

This is directly from step 5 in the ten-step probate process!

The distribution of proceeds will be further evaluated by either the executor or the estate’s accountant to ensure all compliance with taxes and legal fees are met. From there, it is the executor’s responsibility to ensure that all rightful heirs receive their inheritance.

Last step is to obtain final sign off from your probate attorney that all fees, forms and documents have been completed and filed.

Once that is done, you are done!

Kick your feet up and relax. You’ve finished selling a house in probate 😀.

Common Questions: Selling A House During Probate In North Carolina

Q: Do I have to maintain debts, insurance and other probate fees while the property is tied up in probate in North Carolina?

A: Yes, as an executor of the estate, you are responsible for paying all of the loans, insurance premiums and repairs and other miscellaneous property fees while probating the property.

Q: Do all heirs have to agree to sell property in North Carolina?

A: In North Carolina, yes, all heirs must agree to sell the property. If an agreement cannot be reached, the executor force a sale by petitioning the court. Generally speaking, it’s always a good idea to have all of the heirs aligned on the plans for the property (regardless of will and probate terms).

Q: Can I sell my deceased parents’ house without probate?

A: If your name is already on the deed, then yes, you can! Otherwise, probate will be required.

Other Resources & Articles From Doug

Author: Doug Greene

Doug brings over a decade of real estate and business experience to his content. Educating homeowners and helping sellers with their properties is his passion.

His contributions have been featured on Realtor.com, Washington Post, Apartment Therapy, HomeLight, Better Homes & Gardens and many more.