How to Sell a Home in Foreclosure in North Carolina

Knowing how to sell a house in foreclosure can literally mean the difference between losing and saving your home.

Because of that, we take the matter very seriously.

How serious?

This serious:

- We’ve helped over 76 homeowners avoid foreclosure in North Carolina.

- This includes a combined 3,000+ hours of time on the phone with lenders, lawyers, sellers, banks and credit unions.

- We’ve buckled up and drove over 12,000 miles to get paperwork signed and stop foreclosures on courthouse steps.

And in this guide, we will encapsulate all of our tips, trick and strategies so that you can learn how to sell a house in foreclosure in North Carolina.

Let’s jump right in.

- Foreclosure in North Carolina is develops quickly and can catch any homeowner off guard. Adhering to timelines and notices is paramount to avoiding foreclosure.

- If you are behind on your payments, you do have options. Selling your house in foreclosure is just one of them, but there are others.

- Selling your home during foreclosure is easily executed with the help of a cash buyer. You can list your house as well, but be sure to allow enough time and budget to pursue that.

Understanding Foreclosure in North Carolina

Before we can get too detailed and strategical about how to stop your foreclosure or stall it, let’s start with the basics.

We need to make sure we are all speaking a common language around what foreclosure is and how it works – especially in North Carolina.

Last year in North Carolina, one out of every 5,000 homes went into foreclosure. This alarming statistic is continuing to grow as the economy softens and home ownership costs rise.

What Is Foreclosure in North Carolina?

Foreclosures in North Carolina typically follow a non-judicial process.

This just means that lenders have a quicker and easier path to selling your house through a foreclosure sale. With less being required of the lender (less lawsuits, less approvals from judges, etc.) they can expedite the process and begin pre-foreclosure once they have a right to.

Laws can vary by location and property, but in general, many lenders will opt for a non-judicial sale which can be executed outside of the court system. It’s quick and cheaper for the lender and achieves the same result.

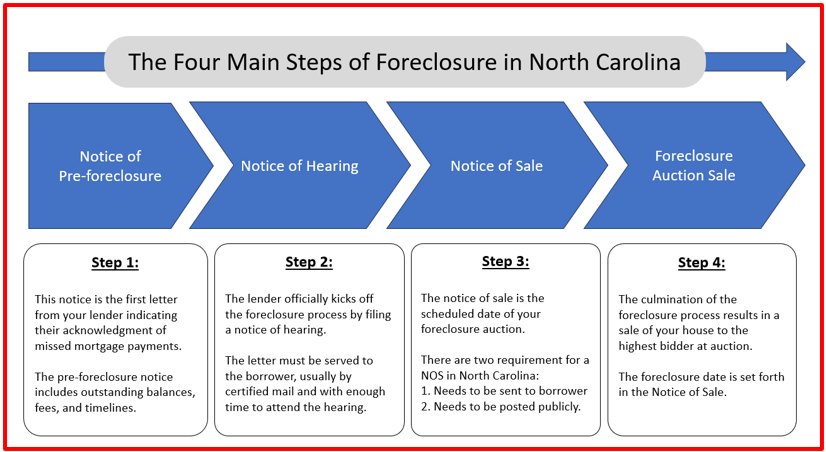

The entire foreclosure process in North Carolina involves 4 main steps:

- Notice of Pre-foreclosure

- Notice of Hearing

- Notice of Sale

- Foreclosure Sale

Laws and statues may change over time so it is best to consult with a licensed and reputable foreclosure attorney. We’ve done some research on your behalf and vetted a few below.

When Does Foreclosure Begin And How Long Does It Take?

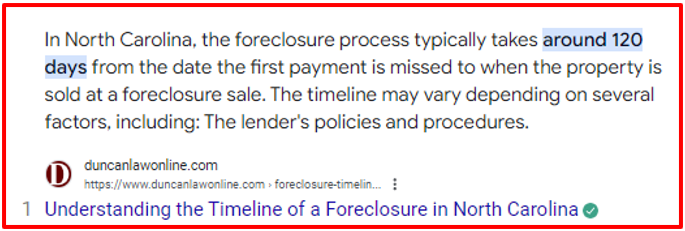

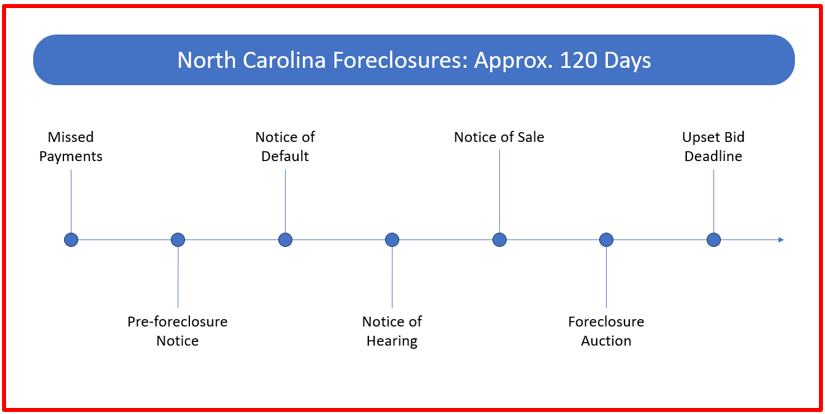

Although foreclosure is most often referred to as a long-winded process, it can unravel quite quickly in the tar heel state.

If you’re in foreclosure, you should expect 3-4 months before this process concludes.

Knowing how long the entire process takes is helpful because it helps you evaluate your options, make plans for the future and communicate to others.

Depending on where you currently are in the foreclosure process, you may have more or less time.

Like most things involving credit and borrowing, the earlier you are the better you can address the issue. Waiting for the last minute, in the case of a foreclosure process: the auction date/sale, is never a good time to begin remediating.

If you need help avoiding foreclosure or would like to sell your house during foreclosure then contact Cash House Closers. We can help you assess your options and fix this issue quickly before it becomes a larger problem.

Key Foreclosure Terminology and Concepts in North Carolina

The last step in making sure you understand all of the basics is getting the terminology down.

Here’s why:

It’s important that you can articulate your plans and communicate with the proper terms that the bankers, lawyers and mediators will be using.

Don’t stress about it.

Just practice and the more you use these terms the more serious people will take you and the better you will navigate a foreclosure in North Carolina.

| Term | Definition |

| Pre-foreclosure | All of the steps, processes and notifications that take place before a property if officially in foreclosure. |

| Notice of Hearing | A legal document that informs parties that they are expected to attend a hearing (includes dates, times, location, etc.) |

| Notice of Sale | A legal document that a lender sends to a borrower who has stopped making payments on their mortgage, notifying them that they intend to take possession of and sell the property in the future. |

| Default | The act of a borrower not making any or all payments on their loan and putting the status of the loan in delinquency. |

| Eviction | Removal of a party from real property through the use of legal force. |

| Judicial Process | When a lender files a lawsuit to enforce foreclosure. |

| Non-Judicial Process | When a lender can foreclosure without going through the court systems. |

| Reinstatement | The act of bringing a delinquent loan (one with missed payments) current again through one lump-sum payment (typically covering missed payments, penalties, late fees, etc.). |

| Bankruptcy | A legal proceeding intended to convey that a person cannot fulfill payments on outstanding debts. |

| Deficiency Judgment | An additional lien against a foreclosed party when the sale of such property does not completely satisfy the loan balance (including penalties, fees, legal costs, etc.). |

| Deed In Lieu | An agreement to deed your property directly over to your lender in lieu of undergoing a foreclosure. |

| Breach Letter | A notice sent to a borrower that their loan is now in default. Typically executed after 90 days of late/missed payments. |

| Redemption | The right to redeem your foreclosed property up to a certain amount of time, and for a certain amount of money, after a foreclosure finishes. |

| Promissory Note | A document, usually signed and notarized, containing a promise to pay a an amount of money to a person or party over a specified amount of time. |

| Deed of Trust | An agreement between a buyer and their lender at the closing of a real estate transaction. |

Can I Sell My Home If It’s in Foreclosure in North Carolina?

Yes, you can sell your house in foreclosure in NC.

In fact, it’s your house, so you can do whatever you please with it. As long as you avoid foreclosure, you can decide what is best for you and your home.

Many homeowners in North Carolina ask this question because they are concerned with the timeline and ability to get the house sold. Make no mistake, you can sell your house but only if it avoids a formal foreclosure from the lender.

In general, this should be the goal of any seller facing foreclosure. You always want to avoid the foreclosure actually finishing or progressing.

Once it does, it can ruin your credit, haunt you finances and continue to plague any ability to ever borrow again.

With that being the case, selling the house before foreclosure is ideal.

Here’s how you can think about that…

Selling During Pre-Foreclosure

There are many benefits to selling your house early on in the process.

Here’s just a few:

- You avoid any headaches from banks and lenders by selling before they give you notice.

- You never put your financials in jeopardy. It won’t impact your overall creditworthiness.

- You are not pressured to sell your house fast. You have time. You can clean, repair and list.

- By selling this early on, you avoid legal fees and many other costs involved in the process.

- Buyers won’t know that you are in distress. Whereas later on, it will be public knowledge.

Selling your house before even giving pre-foreclosure a chance to begin is the best way to avoid the hassle and salvage the equity that you have left in your home. The further along you let foreclosures develop, the more fees and costs they accrue.

Selling After Receiving a Foreclosure Notice

After you receive notice that a foreclosure process has begun, don’t panic!

You still have time.

Remember, 3-4 months is more than enough to get a deal done.

You just need to start. Start now!

There is nothing illegal about selling your house while it is technically “in foreclosure”.

In fact, your lender probably would prefer that to be the case. This way, they won’t end up owning the house themselves (known as REO) and don’t have to further invest money to resell it.

Take your first notice of foreclosure seriously.

And if that means selling, call someone to start that process. Call a realtor, a lawyer or a professional home buyer in your area of North Carolina. These are great resources to accelerate the sale of your property.

Selling Before a Foreclosure Auction in NC

Your last resort to avoid a foreclosure is selling right before the auction.

It’s possible. I’ve purchased homes days before they “hit the auction block”.

It’s not ideal for anyone involved because of the timing and stress it induces, but it is an option.

If you’ve prolonged selling your house in foreclosure in North Carolina, my team and I can help you avoid the auction (even if your auction date is already scheduled).

The first step in stalling the auction is getting a signed purchase and sale agreement.

Once you have this, you can request a postponement. Essentially, you are notifying your lender that you intend to sell the home with a bona-fide offer in hand.

Depending on what county in NC your home is in, you might have as much as 7-10 days before the auction date to make this kind of request to your loan servicer.

Steps to Selling Your Home in Foreclosure in North Carolina

1. Determine What Your Home Is Worth

Lucky for you, finding out what your home is worth is very easy process.

You have many options. The best one will be an appraisal.

Banks typically hire appraisers to determine the fair market value of the property that they are lending on, but you can also hire one for yourself.

Thanks to the internet, finding a great appraiser in your area is easy. And best of all, they provide an honest and unbiased opinion of value on your home.

Check out what a quick search for appraisers produced in Raleigh, NC:

Lots of great options to consider!

2. What Price Will You Ask For?

This is the part that trips up many homeowners facing foreclosure in North Carolina.

Setting your price is crucial. Especially with not having the luxury of time, you need to price the house to sell.

And this often means underpricing your house so that you can get multiple offers quickly.

If you price it too high, you risk not getting any offers in time to prevent the foreclosure from happening. This is a risk you do not want to mess with.

Make sure that the price you are asking for reflects an amount that will satisfy the loan, penalties, late fees and legal fees.

3. Notify the Mortgage Lender

Without letting your lender know that you plan sell the house before foreclosure, you are basically no better off. You need to communicate and do so promptly.

One thing about foreclosure that is vital is the ability to communicate. The bank will be very clear about sending you notices and letters, so you need to be upfront with them about your intentions and responses.

Don’t wait until you have an offer in hand to let them know you are selling. Speak up now and get the idea out in front of them so they know you are putting in the work.

At the end of the day, the loan servicer will want you to sell your house.

Here’s why:

It’s much less work for them to let the property go to auction. It’s also less expensive if you sell it now before foreclosure. And on top of all of that, no bank is in the business of owning homes. They simply want to lend the money.

4. Decide Whether to Sell on Your Own or Hire an Agent

Now that you have a plan to sell your home before foreclosure in North Carolina, you need to execute!

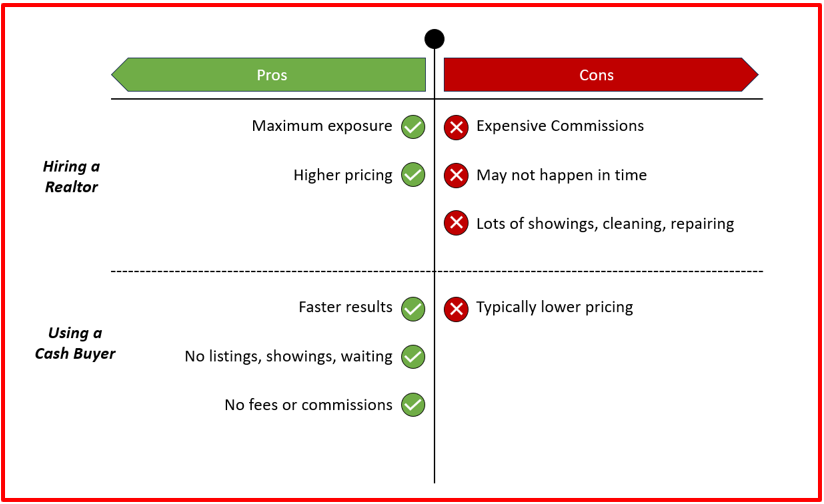

You have two main options for selling your house:

- You can sell directly to a cash home buyer.

- You can find and pay for a real estate agent to sell your house.

It’s a personal decision, but often a difficult one.

Here are the pros and cons of selling a house in foreclosure using each of these methods:

5. Receive Offers & Compare

Hopefully at this point some offers are rolling in.

And the good news is that there is a light at the end of this foreclosure tunnel after all 😀.

Unfortunately, having a house in foreclosure in North Carolina may mean that you don’t have time on your side to negotiate and build up numerous offers.

The most important part of this step is acting quickly. Don’t sit around and wait on an offer. Get one immediately from a local, reputable cash buyer.

Get My Cash Offer Now

If you understand the terms of their agreement (pricing, as is, fees covered, etc.) and would like to move on it, then you should.

Additionally, if you have not done so already, communicate to them that there is pending foreclosure in process. Cash buying companies can help you navigate and delay that process so that you can close and avoid foreclosure altogether.

6. Inform The Lender That You Have a Buyer

Getting to a signed purchase and sale agreement is paramount in foreclosure.

Why?

It’s proof to your lender and others that there is now a pending sale of the property.

My advice from years of experience doing this is to immediately call your lender to let them know you are “under contract”. Fax them a copy of it as well.

The lender is going to want to confirm a couple of key items:

- Does the sale price cover all of the outstanding balances, late fees, legal fees, commissions, etc.?

- Does this buyer have a proof of funding or funds that they can share to support the offer?

- How long will it take this buyer to close and will it happen before the original auction date or after?

Lucky for you, you’re reading this article before you get to this point in your foreclosure sale.

This means you can ask all of these questions to your buyer in previous steps – making this step a breeze!

7. Close The Sale

Once everything is approved by the lender, you can expect the sale to close and a foreclosure to be avoided.

A good closing attorney in North Carolina will escrow the deal properly so that funds are automatically sent to your lender (not wasting any time or additional steps) and thereby closing out your debt with them.

Any surplus funds, which would be your equity, will be paid to you as well.

We find that buyers walk away with 10% more cash at closing from their equity when they contact cash house buying companies sooner in the process.

Challenges When Selling a Home in Foreclosure in North Carolina

Owner’s Death or Absence

In many cases across North Carolina, loans become delinquent because the borrower has since passed away.

This is quite an unfortunate situation.

Not only is the family having to deal with grief and estate planning, but now the house has entered foreclosure as well.

Bankruptcies

Another complication that the foreclosure process runs into often is bankruptcy.

A bankruptcy can stall or even stop a foreclosure sale altogether. And they commonly do go together as both are reflective of challenging financial situations.

If you’re selling your house in foreclosure and you happen to also have an open bankruptcy case, then it’s problematic for your timeline. Having both of these things ongoing at once can sometimes create issues.

While in other cases, some sellers may opt for bankruptcy as a measure of protection. Having the bankruptcy case opened prevents the foreclosure sale from finishing. The downside to this approach is that you will have to deal with a bankruptcy going on your record, whereas the foreclosure can be totally avoided with a simple quick sale.

Selling Alone

Doing anything independently is always incrementally more difficult.

Any to top that, people are naturally stubborn.

With 75% of people not raising their hand for help until it’s too late, you can easily see why selling your house alone can be paralyzing.

There are so many people involved, papers flying around, important dates and so on.

Ask for help.

Start with a lawyer or home buyer who knows the process in your area.

Alternatives to Selling Your Home in Foreclosure in North Carolina

Despite the fact that selling the home prevents foreclosure, you don’t have to go that route with your house in North Carolina if you don’t want or need to.

There are alternative options that you can use to catch up the payments and bring your loan back into a “current” status with the lender.

1. Paying Missed Payments

Bringing the loan current is always a great way to stop foreclosure in its tracks.

If this is your plan, there’s good news: You get to keep the house.

The bad news:

Not only do you need to make the missed payments, but you also need to pay:

- Late fees

- Legal fees

- Reinstatement fees

- Penalties

- And any interest on top of all of those dollars

If this is the plan you decide to take, start by calling up your lender to get a total dollar amount so that you don’t go through all of this effort and still end up delinquent at the end.

2. Loan Modification

Loan modifications are quite popular among homeowners who are facing foreclosure or similar financial challenges.

These modifications are only effective if the lender and owner are aligned to it.

You need a mortgage modification lawyer (your own or that of the lender’s) to help draft the new terms of your loan.

It’s typical for a loan modification to result in lower monthly payments (reduced interest and extended term) in order to prevent missed payments in the future.

Compare everything about your loan mod to your existing loan. Check to see what has changed and ask why. The last thing you want is to sign up for a loan that is difficult to pay.

3. Refinancing Before Foreclosure

Similar to a loan modification, a refinance is another way to prevent foreclosure in North Carolina.

Depending on how much equity you have built up in your property, a refi could help alleviate some of the foreclosure pressures.

In this case, the lender would simply be replacing your current delinquent loan with a new one to prevent foreclosure from happening.

It’s important that you leave enough time to have this happen before the foreclosure.

What can you expect?

In an environment of lower interest rates, this could be a great option as it would reduce your monthly costs and possibly even put some cash in your pocket (without losing the house).

However, you need to be careful to examine the terms of your new loan because it’s possible that the interest rate may have gone up or that the term of the loan could have changed as well.

Do you need to know what rates have been up to recently? Check out this trend over time:

Courtesy of the Federal Reserve Bank of St. Louis

4. Deed in Lieu of Foreclosure

Are all of these options too much? Have you already thrown in the flag of defeat?

This is exactly what a deed in lieu of foreclosure means.

If you know that you will end up giving the bank back the house, then doing a deed in lieu of foreclosure could save you and the bank from all of the extra fees and costs associated.

The benefit is that a deed in lieu circumnavigates the court system as it is between you and the lender. Bypassing that saves you both a lot of extra time and money.

And because it never went to foreclosure, you are often able to negotiate with your lender that a deed in lieu clears you from the debt completely without staining your credit report.

5. Short Sale

Although short sales are an option, in my experience they take a really long time to accomplish and therefore may not be as appropriate for a home going through foreclosure.

With that being the case, it is still an option. It has been done before. And it would be better to have this show up on your credit than an actual foreclosure.

Having the lender agree to a sale of the property at a price less than the loan amount is always an uphill battle, but it can be done in North Carolina.

Here’s when I would entertain the idea of a short sale:

If you and your lender both know the house is not worth as much as the debt AND you have a financial hardship that can be quantified/documented, then you can start that discussion.

Otherwise, if the market value is strong, you have less ground to stand on with a short sale in NC.

Subject To

A “subject to” sale is one of the most underutilized but extremely effective tactics to stopping foreclosure.

In a subject to sale, your buyer catches up your loan, leaves it in place and continues payments on it over time.

What’s in it for you? How about…

- Avoiding foreclosure

- Building your credit over time

- Getting full market value for your house

- Closing quickly

If you’re interested in selling your house subject to existing financing, then don’t trust anyone with the details and execution except a professional home buyer:

Get My Cash Offer Now

FAQs and Common Concerns About Selling a Home in Foreclosure NC

As we come to the end of this guide, we want to be sure you feel confident around what it takes to stop a foreclosure on your house in North Carolina.

Below are some of the most common questions we gotten from readers related to the information we shared.

How Long Does It Take to Sell a Foreclosure Home in North Carolina?

When selling your house with a realtor, you can expect the entire process to take anywhere from 2-6 months (or more). Obviously, this is problematic since the entire foreclosure process in North Carolina only last 4 months. This is where finding a reputable cash home buying company can be a savior. Professional property buyers can close on your house in less than 30 days and expedite the sale.

Will I Still Owe Money After Foreclosure?

After a foreclosure sale, there could be instances where you still owe your lender money. For example, if the property sold at auction for $300,000 but your loan balance was $330,000, then your lender might file a deficiency judgment to collect the remaining $30,000.

Can I Stop the Foreclosure Process Once It Starts?

Yes, you can stop foreclosure in North Carolina. The easiest and quickest ways to stop it is by either catching up the loans missed payments (including penalties and late fees) or selling the house to a buyer. In both cases, it’s best to communicate clearly to your lender what your plan is.

Is a Short Sale a Good Option for Me?

Short sales could work well for you, or they may not. There are many factors that influence how well a short sale could go. In my opinion, if you are considering a short sale then I would also consider selling your house subject to (see above). Selling “subject to” has all of the benefits you can get from a short sale plus more.

Take Action Now, Stop Foreclosure in NC

Now that you know it’s entirely possible to sell your house before foreclosure in North Carolina, what will you do?

This article gives you all the information you need to start the process. Will you?

If I can personally help you avoid a foreclosure in any way possible, do not hesitate to give me a call. My team and I have helped many sellers avoid it and we’re confident we can do the same for you.

However, nothing is possible without the right attitude and resources.

I encourage you to act now if you’re selling a house in foreclosure in North Carolina.

Finding the Right Legal and Financial Resources

Through years of helping sellers with foreclosures, I’ve built relationships with some of North Carolina’s top real estate professionals, foreclosure attorneys, closing attorneys, bankruptcy lawyers and professional home buyers.

Call us. We can help:

- North Carolina Housing Counselors (1-888-442-8188) – Free consultations

- Top Foreclosure Attorney (Jason McGrath) – Offers consultations.

- Bankruptcy Attorney (John Orcutt) – Free consultations.

- North Carolina House Buyers (Doug Greene) – Free offer. No obligation.

Other Resources & Articles From Doug

Author: Doug Greene

Doug brings over a decade of real estate and business experience to his content. Educating homeowners and helping sellers with their properties is his passion.

His contributions have been featured on Realtor.com, Washington Post, Apartment Therapy, HomeLight, Better Homes & Gardens and many more.